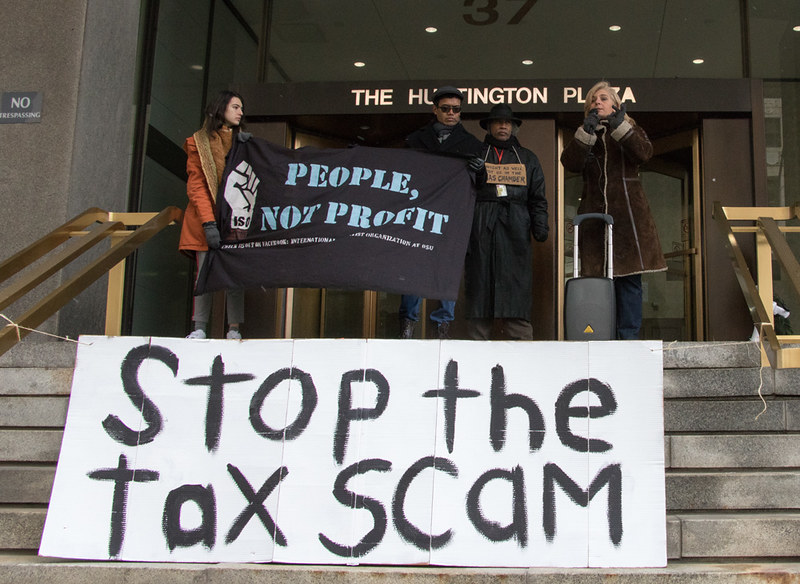

Image: Protest against tax cuts for the rich, in Columbus, OH in 2017. Becker1999 from Grove City, OH / CC BY

Paying tax doesn’t sound very exciting. But taxes help maintain a functioning economy that pays for schools and hospitals and roads and lots of other things we all use and value. Taxes can also be used to redistribute wealth and reduce inequality – but only with ‘tax justice’.

What is Tax Justice?

In a fair tax system, the richest (who can afford the most) should contribute the most: that would be ‘Tax Justice’. But super-rich individuals and companies use loopholes to get out of paying some of the tax they owe, by hiding money in tax havens.

Alongside places such as like Luxembourg, or Delaware state in the US, many of these tax havens are current or former British ‘crown dependencies’ and their history as tax havens is tied to the history of British colonialism and slavery. The ramifications of this history for systemic racism today are explored in this article from Tax Justice Network.

Using these loopholes is technically legal, but it isn’t fair: around £20bn a year is lost this way. The government could do more to close the loopholes, and make sure companies pay their fair share.

Meanwhile, companies that do pay their fair share can register for the fair tax mark. Look out for the mark (left) to support businesses that do the right thing.

A recent poll found that 79% of people in Britain would rather shop at a business that can prove it’s paying its fair share of tax.

Is the UK a tax haven?

On top of failing to tackle tax havens around the world, recent UK governments have made it easier for the UK’s super-rich to pay lower rates of tax than ordinary workers.

Recent research by LSE and Warwick University found that the average person with £10 million in taxable income and capital gains had an effective tax rate of just 21 per cent: less than the rate that would be paid by someone on median earnings of £30,000.

Meanwhile large companies taking advantage of both corporation tax which has been cut in the UK to just 18%, and of tax havens, are asking the government to bail them out with public money during the coronavirus crisis.

As part of the Build Back Better campaign, a group of organisations (including Quakers in Britain and Church Action on Tax Justice) are calling for reforms, including:

- No bailouts for tax dodgers: Require companies receiving large bailouts to end artificial tax avoidance arrangements and tax haven structures, publicly disclose where profits are made and who benefits, and publish their tax policy.

- Tax companies properly: Close down loopholes, end the tax subsidies many companies enjoy, bring in a higher effective tax rate and require the publication of corporate tax affairs.

- Tax wealth more: Ensure that income from wealth is taxed at least as much as income from work. Reform areas where wealth is currently under-taxed, such as property, inheritances, capital gains, dividends and pensions. Actively consider a wealth tax.

- Stop undermining the tax systems of other countries: Shut down the tax loopholes and secrecy provisions that deprive other countries of revenue.

- Enforce the rules: Clamp down on tax dodging. Properly fund HMRC and Companies House, and give them the tools so that they can enforce our laws.

From Tax Justice UK – read more about the campaign.

What can I do about tax justice?

Peace Hub joined with Central England Quakers’ Peace Committee to run an online event on Fair Tax Councils in July – catch up with all the useful info and ideas for action.

Sign Tax Justice UK’s petition calling for No Bailouts for Tax Dodgers.

Churches and individual Christians can explore resources from Church Action on Tax Justice. Other faith groups may be able to adapt some of this material, especially this template letter to MPs.

Check how your own money is being used, including whether your bank is supporting tax havens.

And as always, you can get in touch for more info and ideas for action.